1.

In 1992, Francis Fukuyama’s The End of History and the Last Man landed on the bestseller lists like a kind of coda for the Cold War. Long before the Berlin Wall fell, collectivist systems from China to Latvia were giving way to market-oriented systems; when the Soviet Union finally closed shop in 1991 it was more a ratification than a revolution. So, it seemed, ended the long historical argument over ideal social arrangements, which had found terminal equilibrium in Western liberal democracy.

In 1992, Francis Fukuyama’s The End of History and the Last Man landed on the bestseller lists like a kind of coda for the Cold War. Long before the Berlin Wall fell, collectivist systems from China to Latvia were giving way to market-oriented systems; when the Soviet Union finally closed shop in 1991 it was more a ratification than a revolution. So, it seemed, ended the long historical argument over ideal social arrangements, which had found terminal equilibrium in Western liberal democracy.

I recall reading Fukuyama with a kind of smug complacency, not an unreasonable sentiment given the context: I was living in Hong Kong—revered by Milton Friedman and libertarians everywhere as a perfect laboratory of unfettered markets—and working for the Far Eastern Economic Review, a now-deceased sister publication of The Wall Street Journal, where you checked any regard for government at the office door if you knew what was good for you.

Over time, however, inconvenient facts intruded. It turned out that Hong Kong’s government does quite a lot, from providing housing for about 60 percent of the population to owning virtually every square foot of land in what was then a British colony (today a Special Administrative Region of China), while guaranteeing what amounts to universal healthcare. This is the sort of meddling that is supposed to spoil the economic broth, and yet Hong Kong was one of the richest places in Asia by most standard measures. Something was wrong with this picture.

By mid-decade I was aware of, but could not articulate, an alternative to the market fundamentalism that by then was near-universal orthodoxy. It was probably a review in the International Herald Tribune where I first encountered Robert Kuttner’s Everything for Sale (1997), which turned out to be just what the heretic ordered.

By mid-decade I was aware of, but could not articulate, an alternative to the market fundamentalism that by then was near-universal orthodoxy. It was probably a review in the International Herald Tribune where I first encountered Robert Kuttner’s Everything for Sale (1997), which turned out to be just what the heretic ordered.

Twenty years later, Kuttner (a founder and editor of the progressive quarterly The American Prospect) stands out as a rare voice of reason who accurately diagnosed the libertarian swamp fever of the Clinton era and presciently described where it might lead. If I were teaching a class in political economy, Everything for Sale would be a core text, while Friedman’s wildly influential libertarian screed Free to Choose (1980), which treated Hong Kong as a kind of free-market idyll, would be an amusing diversion, rather like a biologist might treat Creationism.

Kuttner was prescient in a number of ways—in noting, for example, the growing distinction between investors and traders and the transformation of the financial system from a staid means of efficiently allocating capital into the casino that collapsed in 2008.

“Much of the recent debate about how much deregulation is optimal in money markets can be understood as a conversation about the relationship of the financial economy to the real economy,” wrote Kuttner. “The partisans of ever-purer marketization argue that financial markets, by definition, are right in the way they value the assets of companies and how they reorganize those assets. In this view, anything that gets in the way of the smooth functioning of money markets and their rearrangement of assets departs from the market’s wisdom and incurs real economic costs.”

Left unstated, of course, were the economic costs of unregulated leverage and the systemic risk that comes when you don’t “get in the way” of things like “financial innovation,” a euphemism for devices that funnel an increasing portion of the economy into the hands of traders and expose innocent bystanders to inordinate risk. We need hardly add that the market partisans won that debate, and that their victory led in a straight line to 2008.

One of the preferred devices was only just taking off as Kuttner wrote: the credit-default swap (CDS), a derivative that insures bond (or mortgage) payments. The now notorious AIG sold mountains of CDS against mortgage securities it thought would never fail—rather like selling fire insurance to every house in town, only to have the entire town burn down. The mortgage-backed securities they insured, Kuttner wrote a decade before the roof caved in, had done nothing to increase the supply of mortgage credit or to lower its costs: “Mainly, these securities have provided an outlet for one more form of gambling—and enriched the casino.”

2.

Kuttner was at his most effective when making the case for government intervention in healthcare, a challenge that remains—unbelievably—relevant today as Obamacare endures a sustained GOP assault (albeit one that as of this writing appears to have failed). His argument starts with a simple, widely understood premise that the Right either doesn’t get or refuses to accept: that there is a conflict between the profit goals of private insurers and the public-health goals of everyone else.

The faulty assumption behind calls for market-oriented healthcare is the notion that healthcare is no different than, say, the market for cars or laptops, as conservative columnist George F. Will argued when objecting to the “public option” proposed—but ultimately dropped—as a provision of Obamacare. What Will and others casually overlook is that healthcare isn’t and cannot be like other markets, for a number of reasons that Kuttner deftly explored—namely, the near complete absence of consumer sovereignty that disciplines providers in other markets, partly because of the opacity that necessarily attends a market where the consumer is uninformed and providers create their own demand.

Another departure from the market model is that we don’t, and can’t, pay for healthcare ourselves. We necessarily pay for the most expensive care through third parties known as insurers, which immediately introduces a perverse incentive to deny coverage. “The most efficient way to make money in the healthcare business,” wrote Kuttner, “is to avoid sick people or to limit care—maneuvers plainly at odds with our social objectives” of broadly available and affordable healthcare.

Public health demands an expansion of the insurance risk pool to include everyone; that’s how you achieve an efficient allocation of risk. But private insurers demand limiting the pool to folks who are profitable to cover. There are legal and regulatory restrictions on this “risk selection,” but avoiding the people who most need coverage is nonetheless the objective. It’s hard to think of another industry that maximizes profit to the extent that it can withhold its product from the people who need it most.

Once you understand this perverse incentive, which one scholar has termed “the law of inverse coverage,” you understand why we don’t leave the provision of healthcare—or, more to the point, health insurance—to the market. We cannot exclude government from healthcare any more than we can exclude it from national security, unless we’re willing to live with large numbers of uninsured people, a logical consequence of unregulated health insurance.

“Nobody really wants a perfect market in healthcare,” Kuttner wrote. “The essence of markets is to produce both winners and losers. But it is unacceptable that losers should lose their healthcare.” Unacceptable to most people, maybe, but of course most people aren’t writing the GOP alternative to Obamacare.

3.

Where Kuttner explained the fallacies and the hazards of faith-based market fundamentalism, Thomas Frank’s One Market Under God dissected the faith itself, starting with a name, “market populism,” that neatly captured the specious gospel of wishful thinking, high-tech evangelism, and self-serving corporate agendas embodied by the “New Economy” myth—the latest incarnation of the this-time-is-different delusion that has pumped up speculative manias at least since the South Sea Bubble of 1720.

Where Kuttner explained the fallacies and the hazards of faith-based market fundamentalism, Thomas Frank’s One Market Under God dissected the faith itself, starting with a name, “market populism,” that neatly captured the specious gospel of wishful thinking, high-tech evangelism, and self-serving corporate agendas embodied by the “New Economy” myth—the latest incarnation of the this-time-is-different delusion that has pumped up speculative manias at least since the South Sea Bubble of 1720.

Every financial bubble has its foundational myth—“real estate always appreciates” is the most recent—and most follow a trajectory of doom that would probably be more familiar if not for the relentless propaganda of the people Frank hilariously pilloried in One Market. You start with cheap money, which chases the asset of the moment: real estate, dotcom stocks, gold, tulips. The initial surge in price generates what economists call “herd behavior,” which is what happens when people start buying (or selling) just because everyone else is doing it. The subsequent rise in prices to some unsustainable level becomes self-fulfilling, as does the inevitable bust.

A crucial ingredient is the critical mass of people unfamiliar with the very concept of the bubble—partly because they’ve been conditioned, by the people Frank deftly skewers, to venerate the wisdom of the market and vilify its skeptics. As hoary a scam as it is, this-boom-is-different works every time, as proved by the dotcom bubble that was about to collapse just as Frank was writing.

Most of what issued from Frank’s cast of dubious free-marketeers—people like pop-globalist Thomas Friedman, futurist Peter Schwartz, and supply-side guru George Gilder—reads in 2017 like the snake-oil boosterism that it was. But ideas have consequences, as conservatives love to remind everyone, and the consequences of market populism were as profound as they were contradictory. Alongside the ritual New Economy denunciation of media and government “elites,” there was the inconvenient fact that, as Frank noted, “The heroes of Gilder’s populism are men of colossal and arcane financial manipulation: Bill Gates, Andy Grove, John Malone, Michael Milken. It is a populism that… serves to transfer the wealth of the nation upward in a giant heave-ho.”

Perhaps the most dangerous article of the free-market faith, however, was the idea that government—any government—was somehow illegitimate. There was suddenly no distinction between genuine democracies and the gangster regimes of communism and fascism. The ballot box was now obsolete, supplanted by a vast, continual referendum that had rendered political institutions little more than speed bumps on the road to market efficiency. “One dollar, one vote,” pronounced Thomas Friedman.

The road included way-stops to remove restraints from systemically risky financial institutions that had been on a relatively short leash since the 1930s, and to dismiss a late-1990s proposal (jettisoned from something called the Commodity Futures Modernization Act signed by Bill Clinton) to regulate a whole new realm of risk posed by financial derivatives. We don’t need to recapitulate where this led.

Frank called fraud. “One dollar, one vote is not the same thing as universal suffrage, as the complex, hard-won array of rights that most Americans understand as their political heritage.”

4.

How did contempt for government and reverence for markets become so overwrought in the first place? Jacob Weisberg’s In Defense of Government noted that public confidence in government grew steadily in the three decades after the New Deal attempted to put a floor under labor rights, rein in systemic financial risk, and provide the beginnings of a federal social safety net.

How did contempt for government and reverence for markets become so overwrought in the first place? Jacob Weisberg’s In Defense of Government noted that public confidence in government grew steadily in the three decades after the New Deal attempted to put a floor under labor rights, rein in systemic financial risk, and provide the beginnings of a federal social safety net.

The sense that government had failed, and indeed by its nature was destined to fail, was a response not to the New Deal but to Lyndon Johnson’s Great Society. Weisberg notes that there are two explanations for the decline of confidence in government: a conservative narrative that asserted that state interventions had morphed under the Great Society from programs meant to help the broad masses into entitlements that favored marginalized groups and promoted indolence and dependence (the “perversity thesis”). The liberal narrative was that the Democrats lost their majority over racial policies that alienated whites.

Both contain kernels of truth, Weisberg wrote. “Conservatives exaggerate the Great Society’s failures in order to discredit liberalism’s successes; liberals overstate conservative cynicism to gloss over faults of their own.”

But it was the conservative argument, amplified and exaggerated by people like Newt Gingrich, Dick Armey, and a growing right-wing media complex, that drove the free-market utopianism of the 1990s. It led conservatives to the seductive syllogism that since government is necessarily the problem, markets must be the solution, ergo the less regulation the better, and presumably no regulation is best of all.

Kuttner, Frank, and Weisberg are as relevant today as they were 20 years ago because the ideas that they challenged are once again ascendant. Free-market ideology is in large part why Obamacare and the Dodd-Frank financial reforms are under assault. The latter is not just a case of history rhyming; it is history repeating itself. We know what happens when risk-prone financial institutions betting with other people’s money go unrestrained for very long.

These three books did a real public service to the extent that they reminded folks, when it was least popular, that markets need adult supervision and that government is often the only adult in the room. They are, however, no match for the right-wing noise machine that dominates the national conversation and keeps market populism on the scoreboard. I hope I’m wrong, but there’s no reason to think that the free-market, anti-government faith/cult, if unchecked, won’t lead to greater economic and political inequality, scantier access to healthcare, and greater systemic financial risk. If I’m right, all three books could do with republishing. All they’ll have to do is change some names and numbers. The rest will write itself.

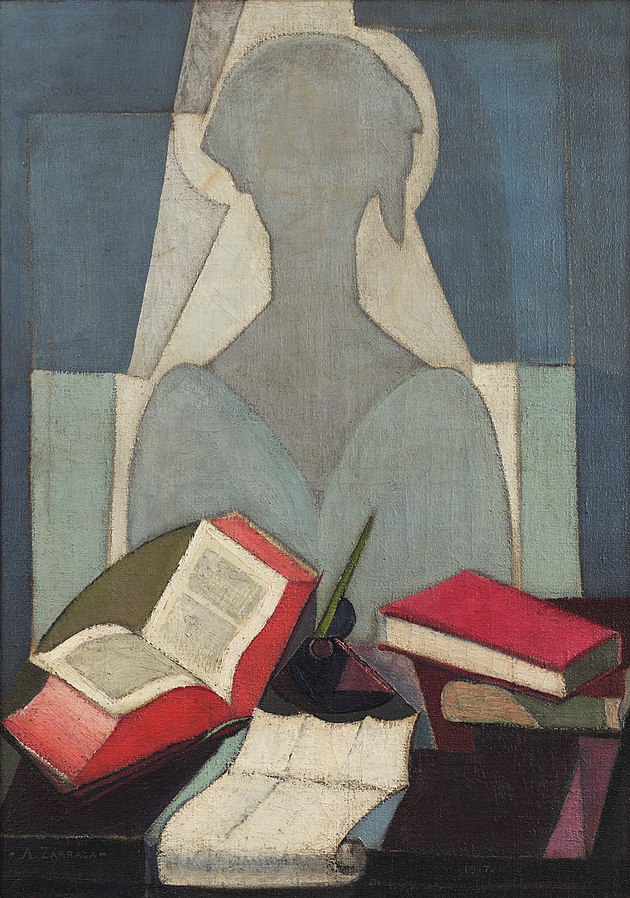

Image Credit: Wikimedia Commons.